Empowering Trust and Efficiency: Seamless Verification, Asset Transfer, and Atomic Swaps with Decentralized Control

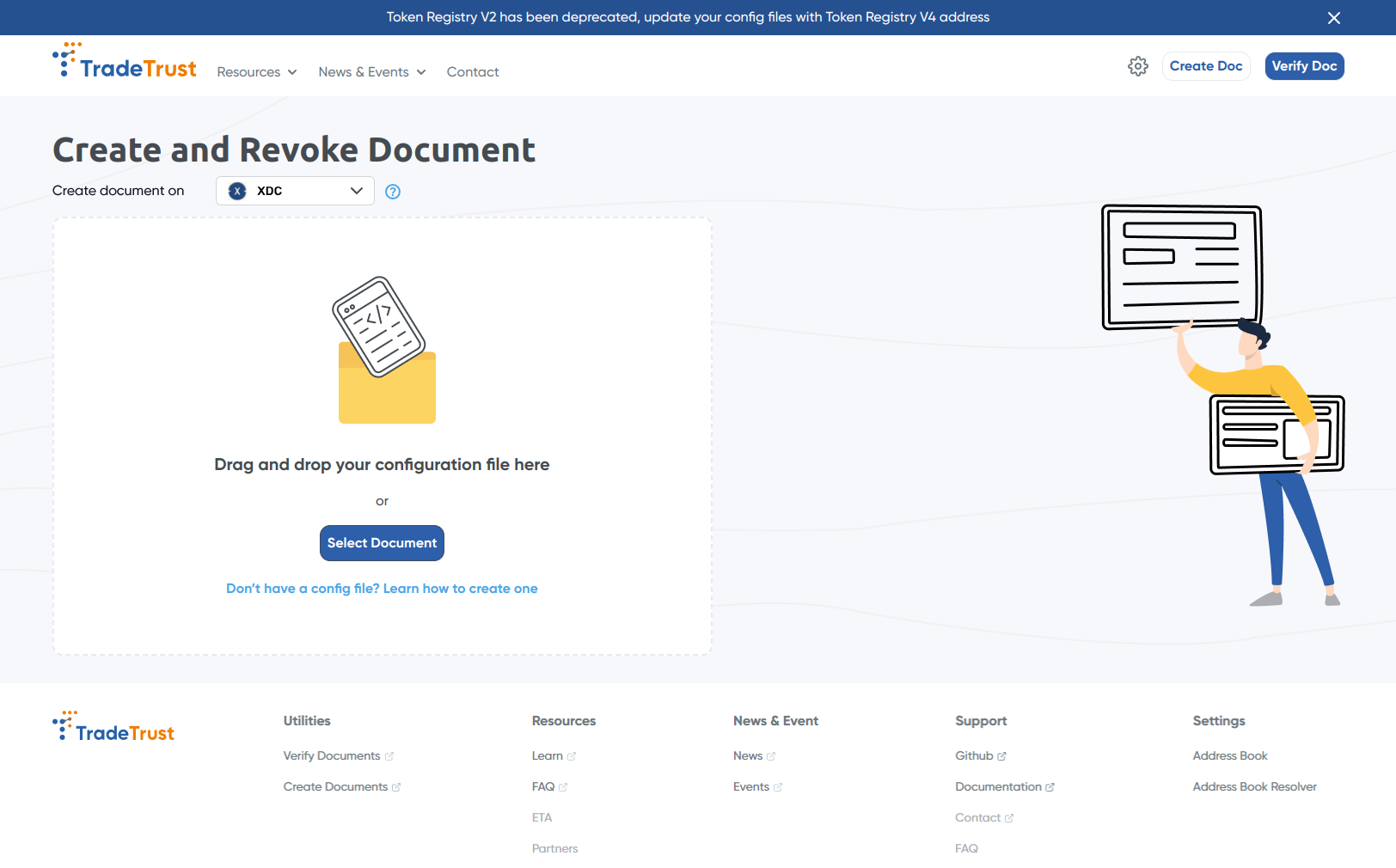

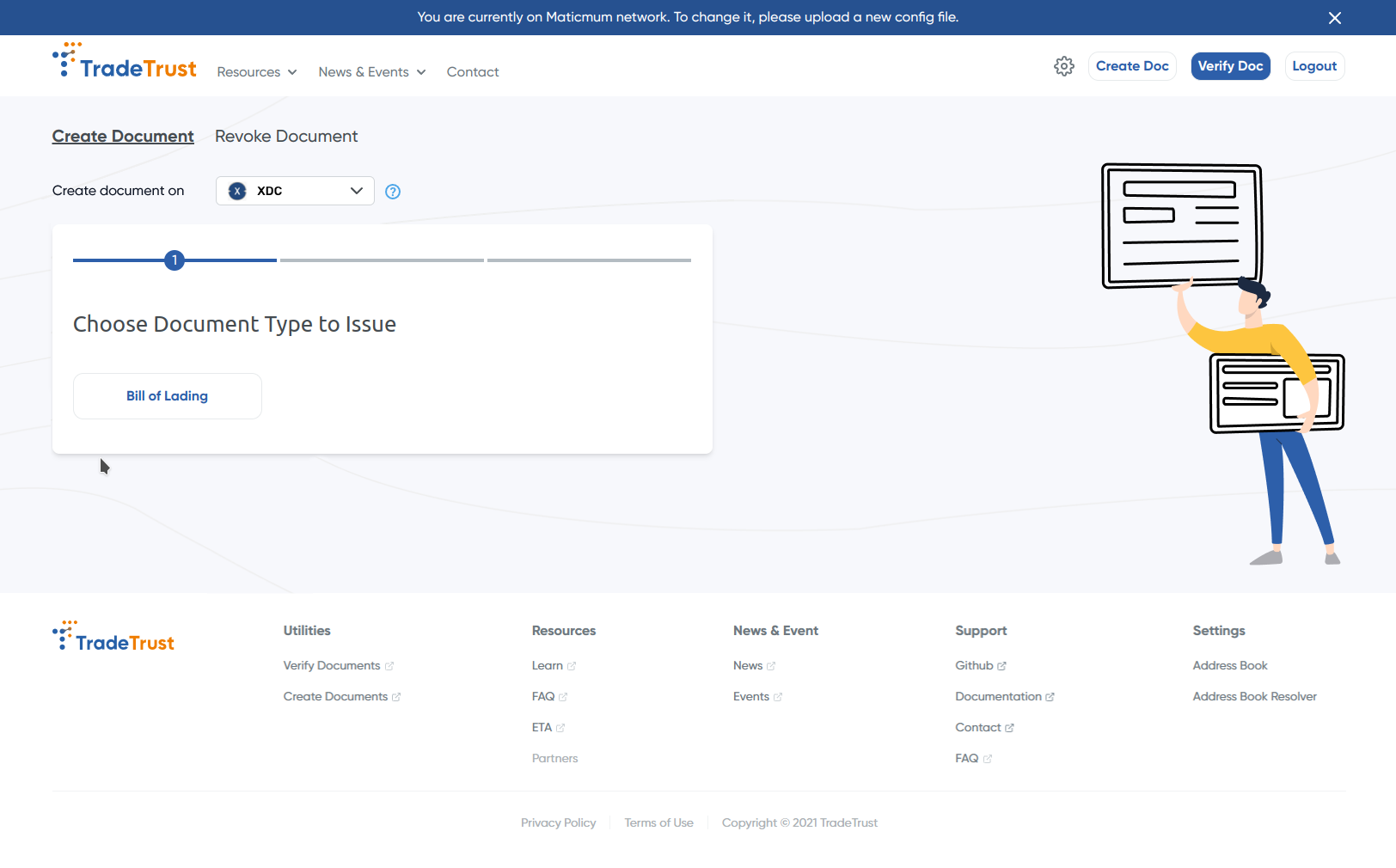

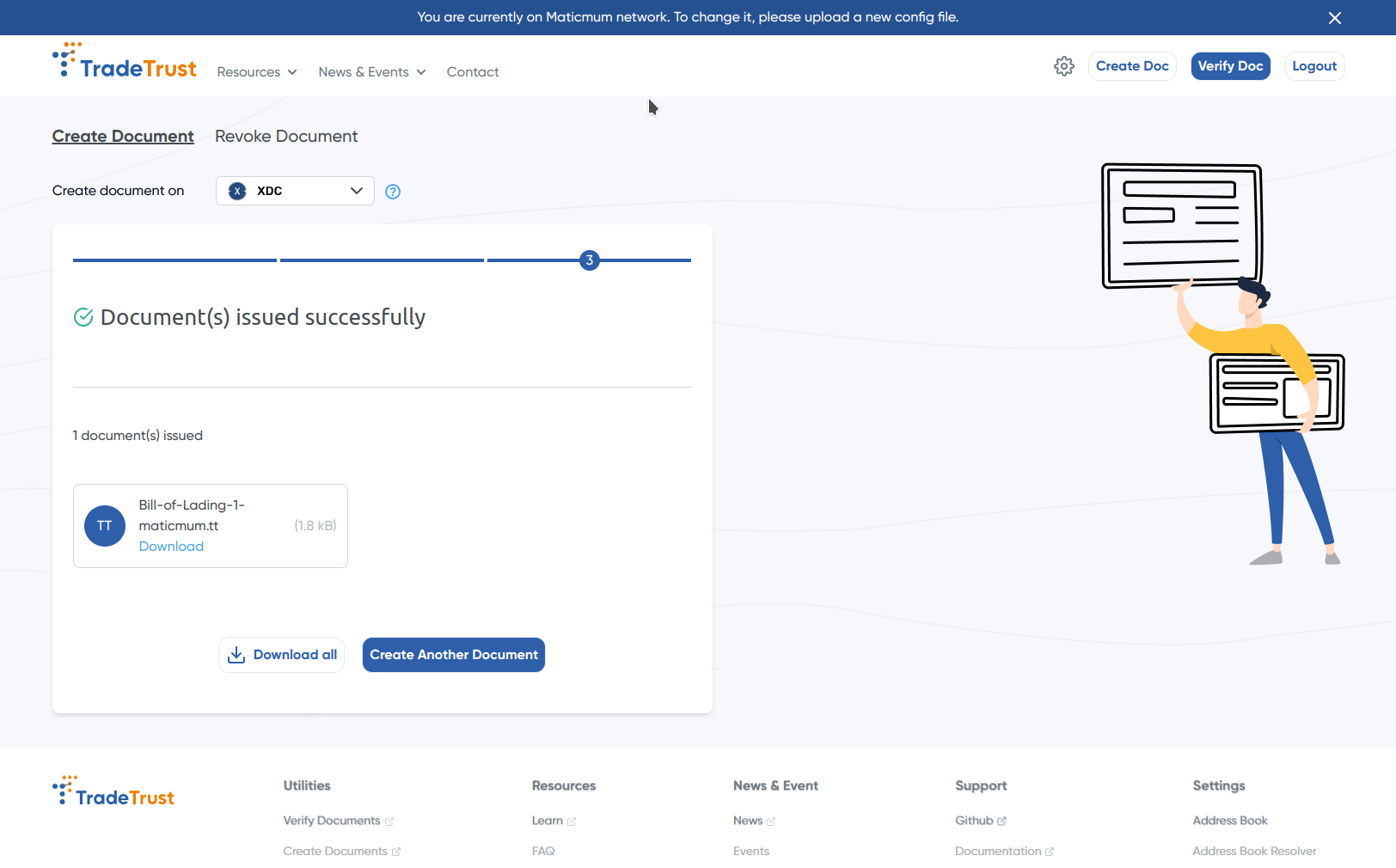

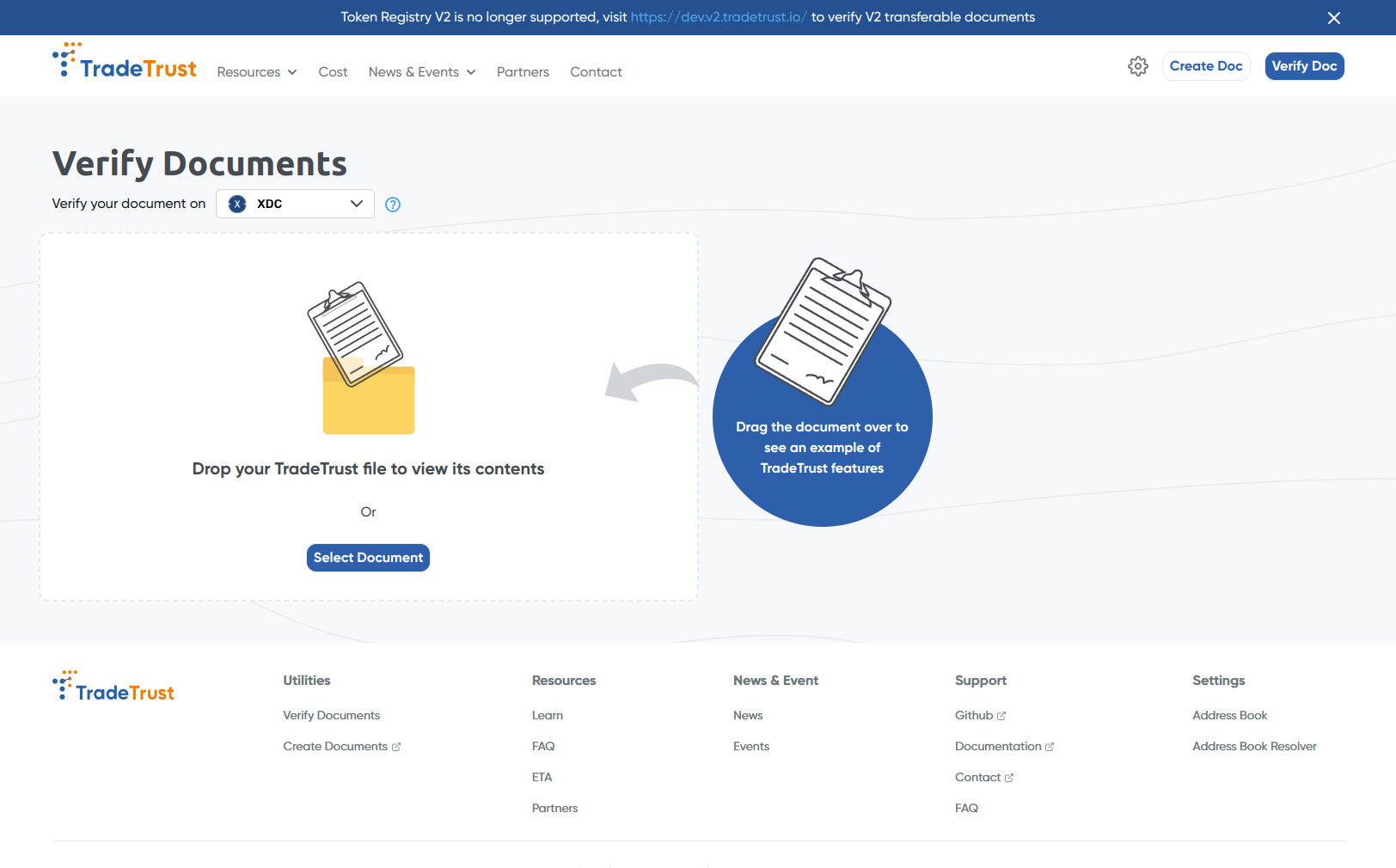

Seamless integration with TradeTrust (IMDA backed & MLETR compliant) public utility built on Open attestation framework.

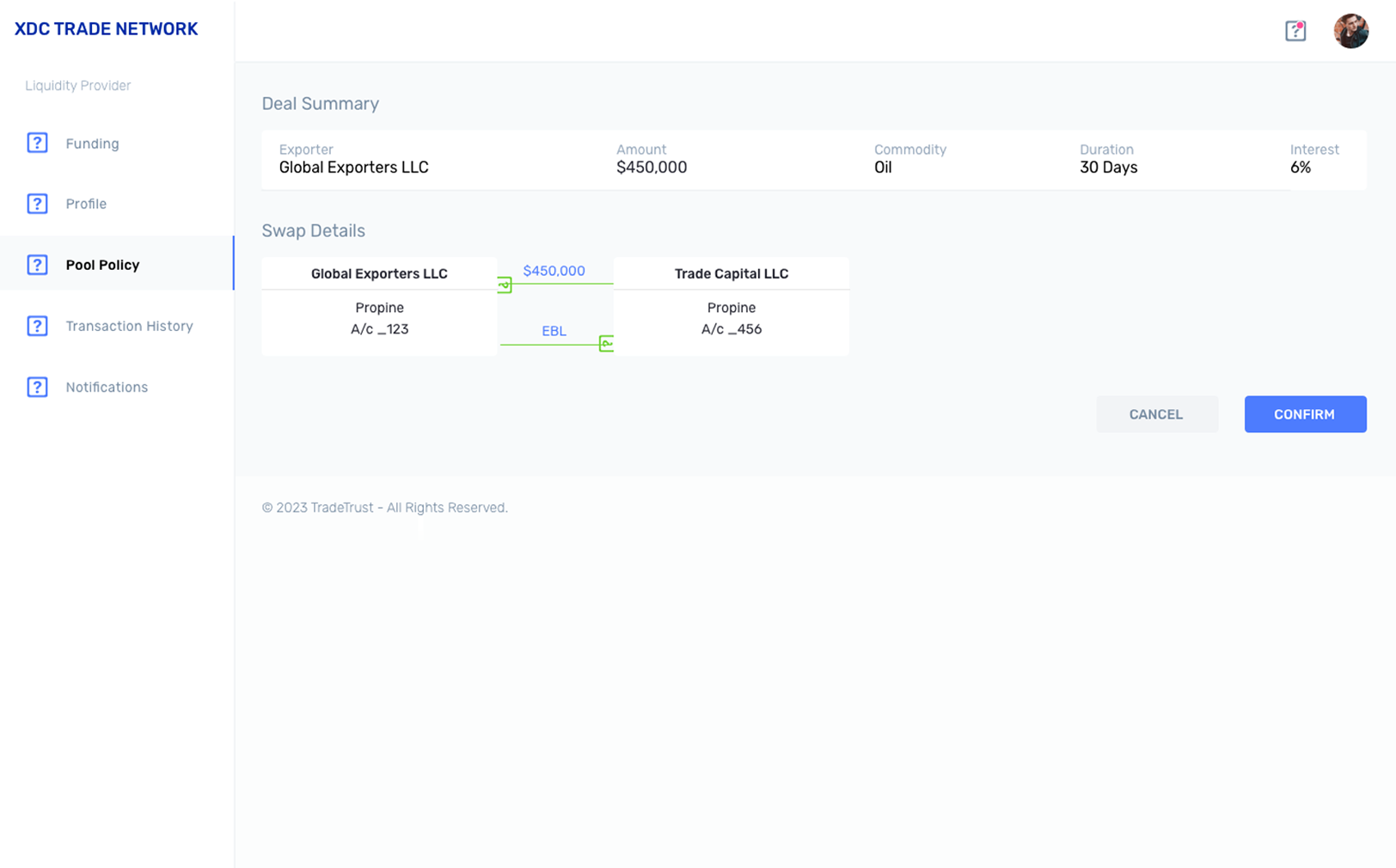

Ability to verify documents and transfer the title of the assets represented by negotiable documents.

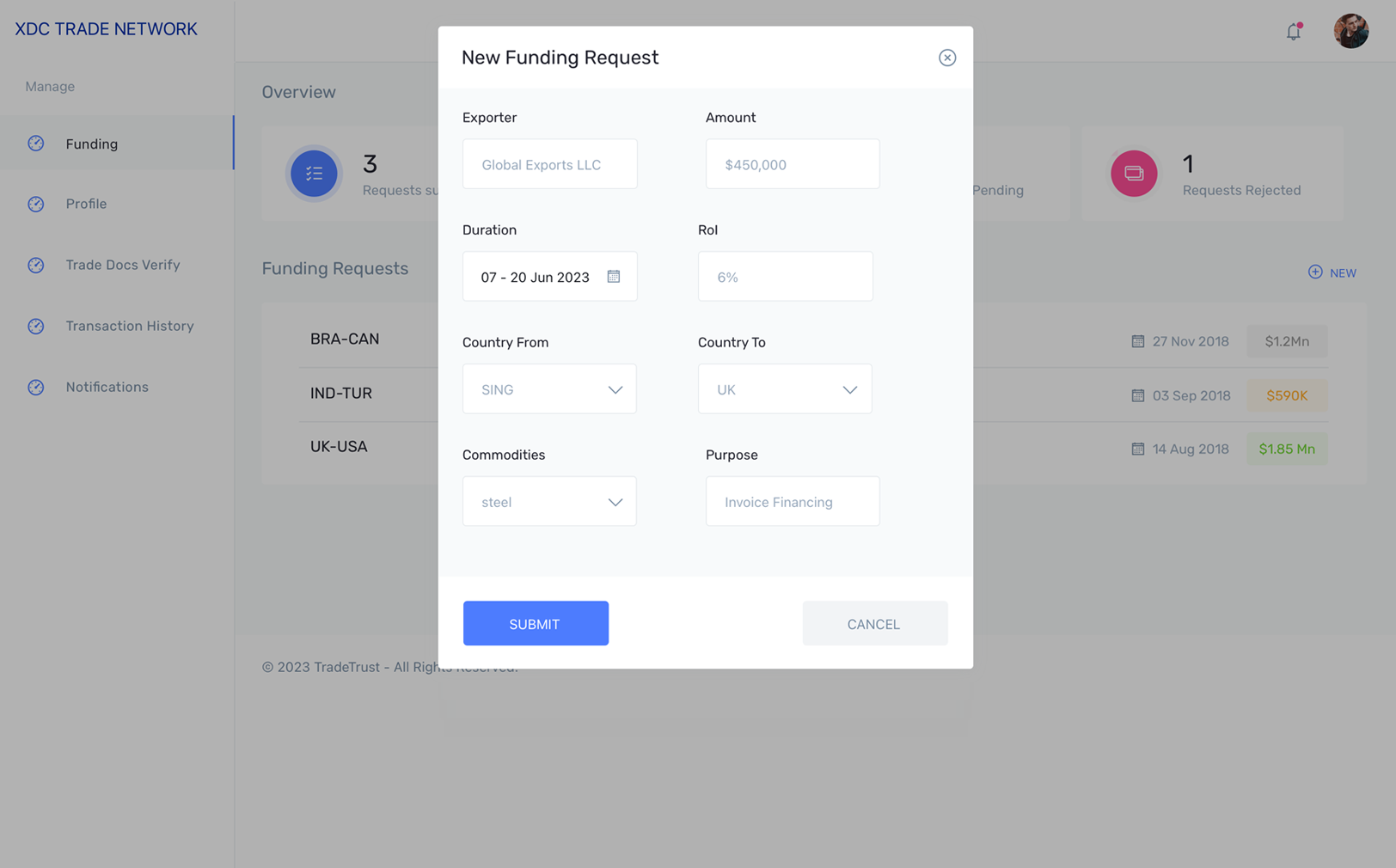

Atomic swap of funds & title ownership using smart contracts, thereby building trust without centralized control.

Transforming Global Trade: A Collaborative Journey towards Seamless Digitalization

Our solution is designed with a clear end game in mind. The objective is to digitalize the entire workflow of cross-border trades and reap the benefits of going 100% digital. We are built on open standards, hence easy to integrate with any like-minded solution. Global trade is complex with many processes needing specialized solutions; hence collaboration is the best approach. We thank the various trade bodies, standard organizations, trade participants, regulators, and the ecosystem working with us.

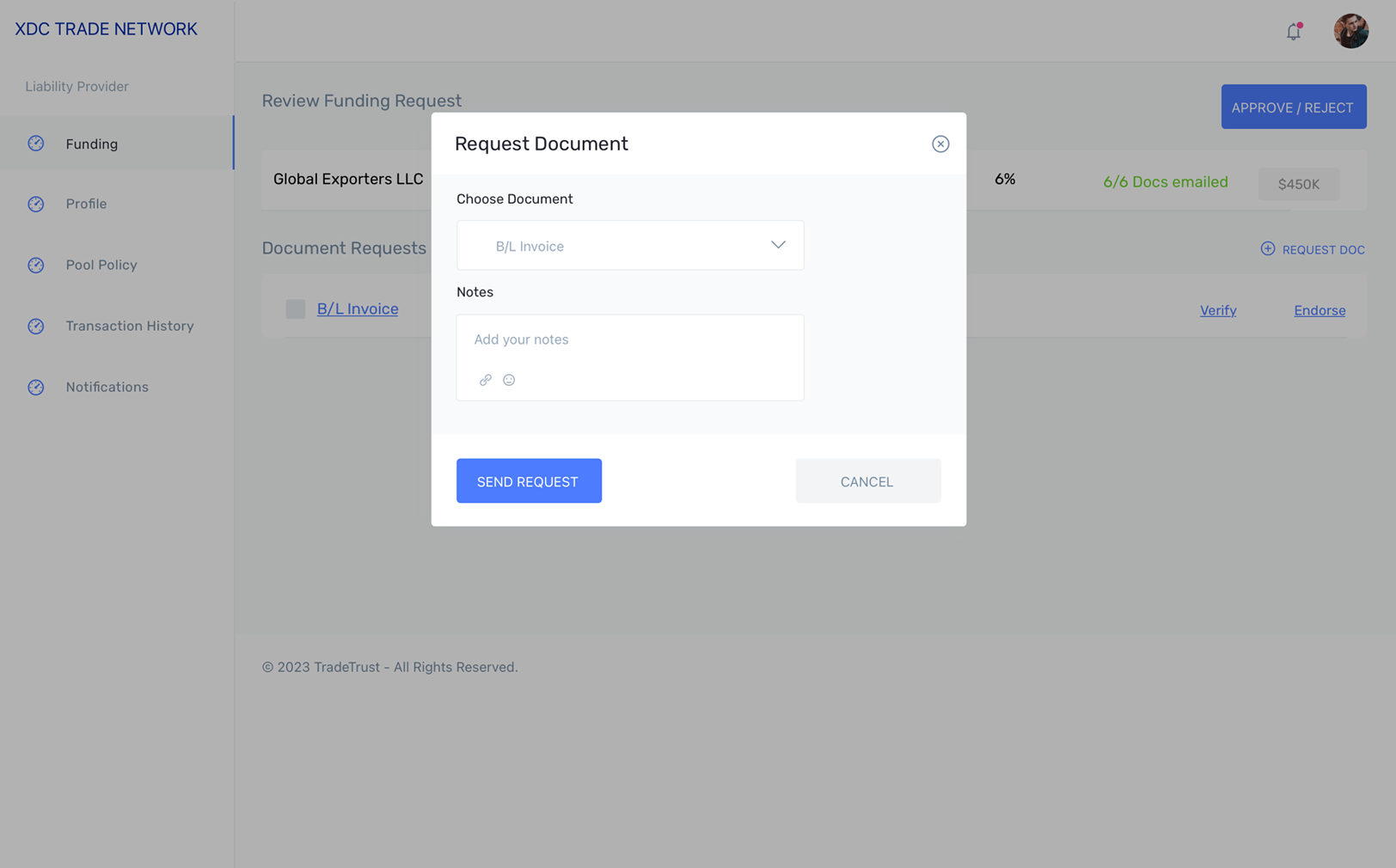

XDC Trade Network is an innovative solution that offers trusted interoperability amongst the applications which are MLETR-compliant. This will enable the exchange of electronic trade documents across different digital platforms bringing in the network effect the industry has been waiting for. Some of the key documents are as follows –

Warehouse Receipts

Certificate of Origin

Commercial Invoice

Packing List

Bill of Lading

Customs/Goods Declaration

Insurance Certificates

A shipper can raise capital in exchange for the above documents created on an MLETR-compliant solution. Shippers and liquid providers would be on-boarded our solution thru a regulated Digital custodian. Thus, we are bringing capital for all the trade documents created on an MLETR-compliant solution. There is a big interest from the liquidity providers to address this asset class.